Jesus often spoke in parables and fulfilled the prophecy that he would speak things that were hidden (Matt. 13:34, 35). The parable of “The Unjust Steward” or “The Shrewd Manager” in Luke 16:1-13 is possibly one of the most difficult of Jesus’ teachings to understand. Interestingly, it precedes a very familiar and often-quoted verse (13) which says, “You cannot serve two masters…You cannot serve God and be enslaved to money.” This shrewd manager, despite his unrighteousness, was “praised” by his master which is the shocking part of this parable . There is a powerful truth about eternal perspective revealed in this parable.

The facts are important and need to be clearly understood:

1. The main character has the job of stewarding the assets of "a certain rich man."

2. There is going to be an audit of the books because of the steward’s poor management.

3. The steward’s days in his role are numbered because of the "squandering of his (the owner’s)possessions."

4. The steward uses the relationships that he has developed to re-negotiate the debt that is owed his master.

5. Despite being “unrighteous” or “unjust” he is praised for his “shrewdness” in his handling of the circumstance.

What principles can we apply to our own management of money and possessions? Here are some of my conclusions:

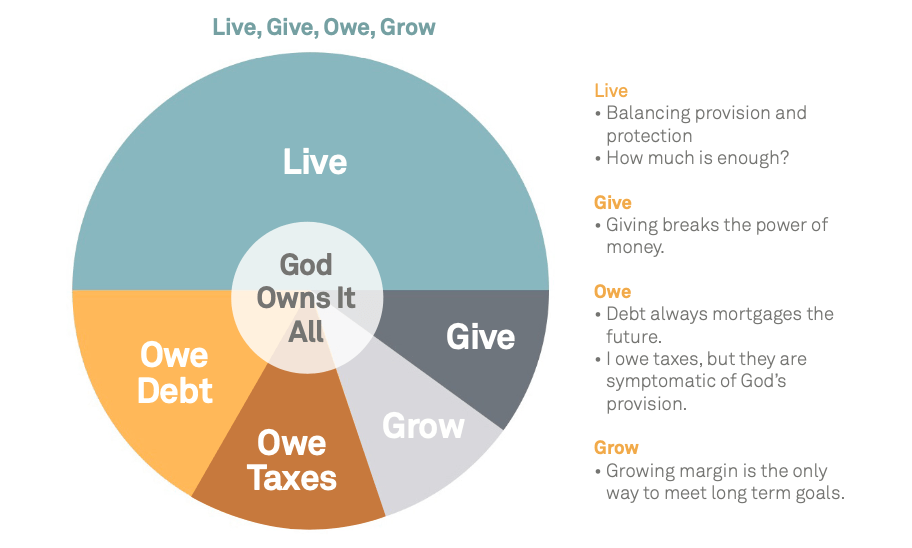

1. The main thing that we need to understand about this life is that ultimately our role is to be a steward over what is put into our hands.

We are each given talents “depending on each one’s ability” (Matt. 25:15b). My goal is to invest my gifts with the time I have to bring glory to God. We have also been given resources (or treasure) to manage. The Lord also gives us relationships which is often an overlooked element of our stewardship responsibilities. The requirement of a steward is to be found faithful (1 Cor. 4:2).

Understanding that whatever we have in this life belongs to another is a very deep concept. We work and earn money so it is easy to assume it belongs to us. The Israelites had the same thoughts but in Deut. 8:18 it is made clear that it is God who gives us “the power to gain wealth.” This parable teaches that we are called to be faithful in what belongs to someone else (Luke 16:12). Considering what we have been called to manage, it’s definitely a high calling.

2. At some point, the books will be audited.

As followers of Christ, our lives will be examined or judged by God with the goal of providing a reward. Paul describes how our works will be revealed or become obvious; “the fire will test the quality of each one’s work” (1 Cor. 3:13b). What we do with the resources we have been given may have no eternal consequence (they are burnt up or consumed) or they remain after being tested.

Some of the final recorded words of Jesus are these: “I am coming soon and my reward is with me to repay each person according to his work” (Rev. 22:12). This is likened to a settling of accounts (Matt. 25:19) and the goal is to hear the words: “Well done, good and faithful servant!” (Matt. 25:21).

3. We must understand that we have a limited time to accomplish the goal.

This adds a significant level of urgency to the management of the resources we have been entrusted with. To realize that we are “created in Christ Jesus for good works, which God prepared ahead of time for us to do” is a very sobering thought. Are we completing that work or are we squandering the opportunities that present themselves during our days? There is a reason for the instruction: “Teach us to number our days” (Psalms 90:12).

For this manager, the loss of his job made him think more deeply about his options. He knew he had a limited time to act, so he called the clients for a final meeting. This is certainly one of the reasons he is considered to be shrewd.

Shrewd” is not necessarily negative – to call a businessman shrewd is generally a compliment, meaning “taking advantage of hidden opportunities”.

Until he was faced with this personal crisis, this opportunity was hidden to him and not a consideration. In a similar fashion, we do not have unlimited time and we all could use more wisdom that comes by numbering our days. Maybe the difficult things we face (like job loss) in life, have the purpose of growing wisdom within us.

4. We need to understand that the relationships that we have with others are truly a gift from God.

“When you are with people, they are his people, relationships he’s given you, people whom you can serve with eternal values at heart.”

Ken Boa, Rewriting Your Broken Story, p. 15

This may require us to intentionally focus on those relationships strategically in order to accomplish all that God intends for us to produce from that relationship. Consider that God actually has a plan for each of those relationships and he positions us at the right time in that person’s life.

What happens next is most interesting: he calls “his master’s debtors and reduces their debt, thereby engendering their friendship.”

Randy Alcorn, Money, Possessions & Eternity, p. 142

From the point of view of the debtors, the steward will have used his last moments in office (though they will only learn later that these are his last moments in office) to show generosity to them on a grand scale. The ancient world ran on the basis of a reciprocity ethic: good turns given and returned. The steward’s move gave him a claim upon his master’s debtors that was much more secure than any contract. Public honor required that they make some appropriate return to their benefactor. The steward had secured his future!

John Nolland, Luke 9:21–18:34, vol. 35B, Word Biblical Commentary (Dallas: Word, Incorporated, 1993), 796–803.

5. The results that will bring praise from the master is when the impact reaches beyond this temporal life and extends into the eternal.

What the steward is praised for is not his unrighteousness but his “shrewdness” or “prudence.” This is the key that unlocks the parable. He is indeed a “son of this world,” but he is more prudent in planning for the only future he is concerned about than the typical religious person is in planning for his eternal future with God.

James R. Edwards, The Gospel according to Luke, ed. D. A. Carson, The Pillar New Testament Commentar

The “worldly wealth” can be used strategically to invest in relationships with people. Only then can it be transformed into “true riches” (v. 11). The parable ends in verse 8 when the steward accomplishes his goal. What follows is the instruction to use “worldly wealth so that when it fails, they may welcome you into eternal dwellings.” Why was this steward “more shrewd than the children of light?” It might be because he acted according to his worldview (securing his future).

The natural inclination is to view all of the resources as our own (just as the children of this age do). This parable demonstrates the importance of managing prudently the relationships and resources on behalf of the owner or master (the task of the children of light). Instead of squandering the “worldly wealth” we ought to seek out hidden opportunities, likely relationships we already have. We are to become “faithful in the use of that which is another’s …” (v. 12).

The unrighteousness manager’s actions were consistent with his worldview more than the actions of most followers of Jesus are consistent with their worldview. The instruction of Jesus is: “store up treasures for yourselves in heaven.”

We can accomplish this by our “shrewd” use of “worldly wealth.” To be shrewd means to find hidden opportunities to live according to our worldview, as citizens of heaven. This means we make investments that are long term … really long-term, as in eternal!

How shrewd are we in handling the resources that are placed in our hands? Are we looking for hidden opportunities to use “worldly wealth” to establish “true riches?” (cf. v. 11) Are we living as citizens of heaven, while we are citizens of this earth?