There are so many places that our money can be directed so it is important to set our priorities. One priority already set for the majority is tax, since the income tax act requires that taxes are deducted at source before we receive our pay. The more one makes, the more gets deducted.

One of the more challenging areas is our lifestyle because we always seem to want a larger lifestyle. We like to have a newer car, the latest cell phone, another toy and the list goes on. For this reason, limiting our lifestyle spending is never easy.

It has been said that lifestyle spending accounts for 40-70% of where our money goes. Please note that lifestyle spending is different than “living expenses” because lifestyle is about what we want, not just what we need to live.

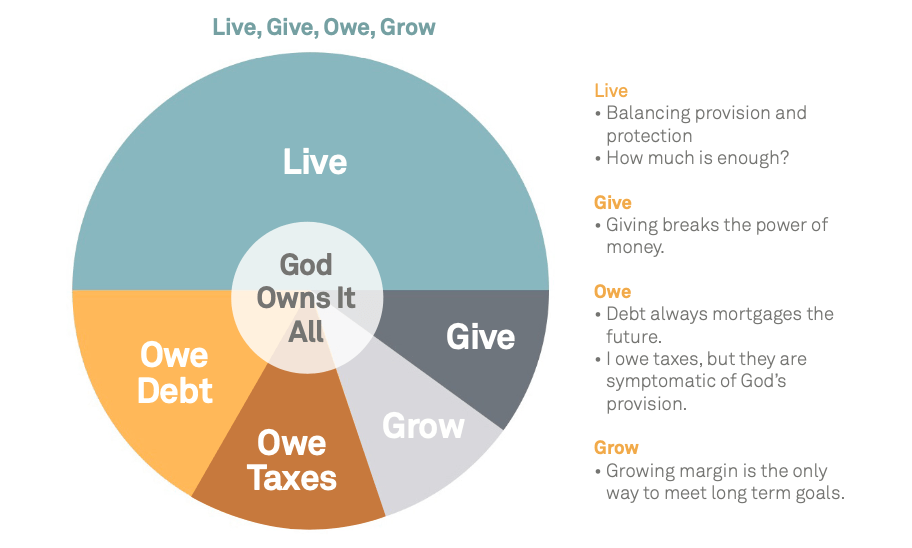

Have you ever calculated how much of your monthly expenditures is directed toward lifestyle and these other areas? There is a simple tool in the form of a pie chart that I have used to determine the percentage of money that goes to each piece of the pie.

Your tax return can provide some of this data: start with your gross income, then subtract the tax you pay, then take off the amount you save (if it’s in your RRSP, you can find this on your tax return) and subtract your charitable giving (also on your tax return if given to a registered charity). Finally, subtract what you pay annually in debt (which typically is an extension of your lifestyle). What remains is your lifestyle. (Income – tax – debt – saving – giving = lifestyle).

In the Kingdom Advisors Study Group this month, Founding Director, Ron Blue shares the story of a couple who desired to give more than 10%. Might that be a goal for you?

This couple was spending 52% on lifestyle and 15% was going to pay on the debt. The reason for the debt was paying off things like an RV, motorcycles, boats – the toys or the extras. The toys are great to have but maybe not used as much as when first purchased.

This couple made the decision to sell the toys (for what they were worth – less than the purchase price) and eliminate the debt. They allocated this 15% to their giving, so they now gave 25%! This in turn reduced their taxes by 10% – that’s a definite win! This 10% allowed them to boost their savings and even add to their lifestyle boosting it to 59%.

Just think about that result for a minute: paying 10% less in tax, saving 3% more, giving 15% more and spending 7% more on lifestyle; who can argue with that? Most importantly, this couple was more content than they were previously. It came by eliminating the debt.

As a couple, we have calculated this in the past few years and have found it extremely useful, because like this couple, we were not 100% content and wanted to make some adjustments in our pie chart. In particular: decrease (or eliminate) debt, give more and pay less in tax.

How about you? If you would like to calculate your own, you can download the tool here: https://ronblueinstitute.com/tools/#budgeting_tools

Revisit your own pie and priorities on an annual basis. Maybe some adjustment might be exactly what you need!