I’ve been looking at some stats as part of a research project to determine the need for financial advice that aligns with the values and priorities of Christian consumers in Canada.

Financial Advisors in Canada

Firstly, what is the total number of financial advisors in Canada? According to an Advocis report released in 2012 there were just over 90,000 financial advisors.

In 2020, the Mutual Fund Dealers Association (MFDA) released a client research report, which stated the total number of advisors had grown to 136,000 as of January 2019. (The Investment Industry Regulatory Organization of Canada (IIROC) is the pan‑Canadian self‑regulatory organization that oversees all investment dealers and trading activity on Canada’s debt and equity marketplaces).

In a Sept. 29, 2022 press release, IIROC announced that MFDA & IIROC “have passed a special resolution approving the amalgamation of the two self-regulatory organizations (SROs). Effective January 1, 2023, subject to the conditions outlined in the Combination Agreement, the MFDA and IIROC will become one organization that will temporarily be known as the New Self-Regulatory Organization of Canada (New SRO).” This release stated that the approximate number of MFDA approved persons are 76,695 plus another 32,000 registered employees with IIROC. This means the New SRO will have 108,695 total advisors serving the Canadian public.

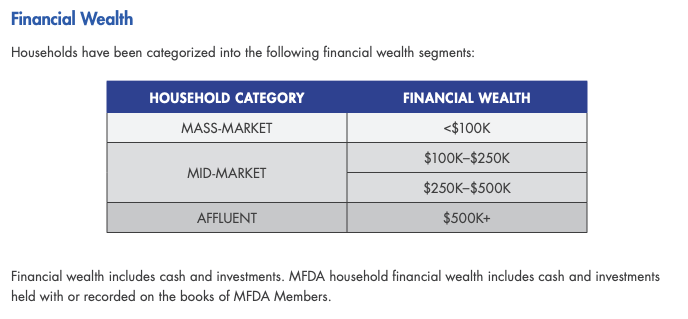

Financial Wealth in Canada

Next, it’s important to understand the level of wealth held by Canadian households. The MFDA Client Research Report also revealed that there are 16.2 Million Canadian households holding 4.4 Trillion in financial wealth.

Most households in Canada (79%) are mass-market households who own $100,000 or less in financial wealth (not exactly the target market for financial advisors). However, mass-market households only own 4% of the $4.4 trillion in financial wealth in Canada. Conversely, affluent households represent only 10% of all households in Canada but own 86% of the $4.4 trillion in financial wealth. Mid-market households represent 11% of all Canadian households and own 10% of total Canadian household financial wealth.

Wealth held by Christians

According to Pew Research published July 2019, 55% of the Canadian population consider themselves Christian. This would mean 2.42 Trillion of financial wealth is in the hands of Christians among 8.9 million households.

The research further shows that 33% of Canadians say that belief in God is essential to have good values. It is quite natural for clients to work with an advisor who shares their values. This would mean that over 5.3 million households in Canada would prefer to work with a Christian advisor; one having values based on a belief in God.

In the Investment Executive’s 2021 Dealers’ Report Card: The average advisor reported serving 206 households. This means that 26,500 advisors would be needed to serve the 5.3 million Christian households.

However, not all of these households are the ideal clients for advisors. The MFDA report showed that 79% of these households are mass-market, meaning they have less than 100k to invest and are therefore not the target market for advisors. The remaining 21% are mid-market (100K – 500k) or affluent (500k+), which is the target market for financial advisors (or 3.4 million households). This would mean that 1.87 million would identify as Christian (55%) and 1.12 million households (33%) would have values driven by their belief in God.

How many Christian advisors are needed to serve these 1.12 million households who say their values are driven by their belief in God? If we take the average advisor serving 200 households – a minimum of 5,600 Christian financial professionals are needed in Canada. To serve those who identify as Christian (55%), 9350 financial professionals are needed. (As a side note: it has been debated whether an advisor has the capacity to adequately serve 200 households effectively – the number is probably closer to 100 families, thus increasing the need for Christian advisors).

Certified Kingdom Advisors are Needed

The Christian market segment has specific financial planning and decision-making differentiators that are important in their selection of a financial advisor, based on their religious/faith paradigms including: planning areas and common language, financial stewardship, debt, lifestyle, investing, charitable giving, estate planning and wealth transfer, generosity, and retirement planning.

One of my mentors, Ron Blue, who is also the Founder of Kingdom Advisors, believes that “everybody’s advice and counsel comes from a value system. What I learned as a CPA and a Christian is that good advice has its roots in wisdom that is thousands of years old. I am applying this wisdom to decision making regarding money.” He also says, “There is a big difference between a Christian who is a financial advisor and a ‘Christian financial advisor.’ A Christian financial advisor integrates their faith into their professional advice.”

The CKA® designation is designed to build on an advisor’s base of technical competency and experience as evidenced by an approved industry designation, or a minimum of 10 years full-time experience in a specific financial discipline. The earning of the designation is a pathway for a Christian who is an advisor to become a Christian financial advisor. There is a significant need for sound financial wisdom in Canadian households, which can come through trained Christian financial advisors.

Financial advisors can learn more here: https://kingdomadvisors.com/