I recently had an eye exam and there was no significant change in my prescription. This reminded me of the words of Jesus in the famous Sermon on the Mount. I googled the verse of interest and immediately received this AI generated overview:

The Bible verse “If your eyes are healthy, your whole body will be full of light,” is found in Matthew 6:22. It essentially means that if your mind and heart are focused on good things, your whole life will be filled with light and positivity. If your “eye” (representing your inner self) is not focused on God, the truth, and good things, your whole life will be filled with darkness.

Is Your Eye Healthy?

That certainly seems to be a reasonable explanation, but is that really the extent of what Jesus was saying here? To fully understand, might I suggest we need more SI (Spiritual Insight), since AI (Artificial Intelligence) has its limits. Maybe a quick look at the context of this verse might give us a clue.

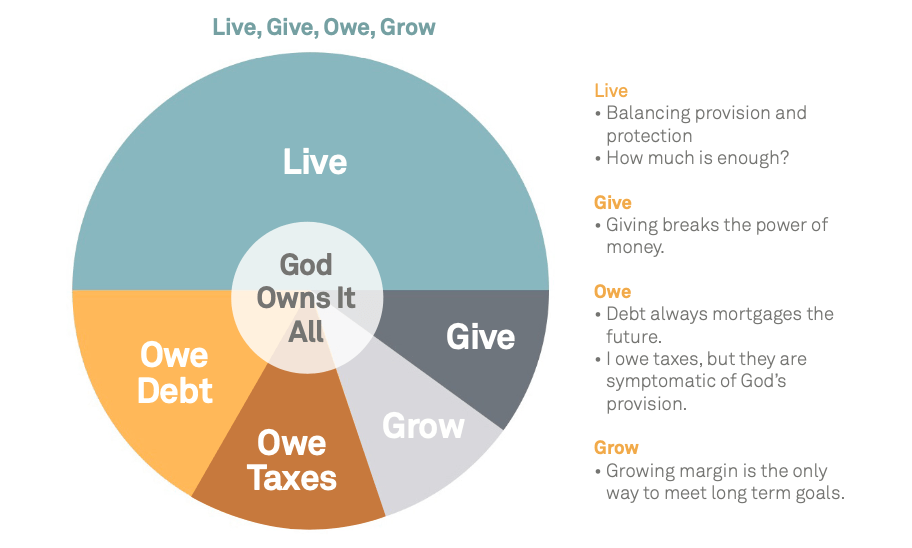

Matt. 6:20 talks about treasure and the places it can be stored (heaven or earth). The next verse connects our heart with where we place our treasure. Inserted here are two verses about having a healthy or clear eye vs. an evil or unhealthy eye which results in darkness. This is followed by the reference to two masters and the inability to serve both with the simple conclusion: “You cannot serve God and money.” Then, the instruction to not worry about the things needed in life, like food and drink and clothes – some of the things we purchase with money.

With this context in mind, why does Jesus speak about the eye being good or evil, bringing light or darkness? Could the health of the eye be a reference to our attitude about our financial resources?

Is Your Eye Envious?

This is not the only time Jesus referenced the eye. In Matthew 20, He spoke about “the kingdom of heaven” being like a landowner who hired workers for his vineyard. These individuals were hired at different times during the day – some early morning, others at 9 am, others at noon, then others at 3 pm and more at 5 pm. At the end of the workday, the workers were called to receive their pay, “beginning with the last ones hired and going on to the first” (v. 8). Naturally, the people who worked the entire day expected to be paid more than those who started work at 3 or 5 pm and this led to complaints.

The story concludes with a few questions:

“Is it not lawful for me to do what I wish with what is my own? Or is your eye envious because I am generous?”

In this story, Jesus was illustrating that the darkness on the inside of these workers was due to a desire for more (an amount above the original agreed amount). All day these workers knew what they were going to be paid but this focus shifted when they saw that others who worked less were being paid the same (meaning their hourly wage was less than those hired later). There was an immediate discontentment when they compared themselves with people who were hired 8 hours later. Comparison is the enemy of contentment.

Let’s assume you or I were hired at the start of the day – would we be any different? If we worked 10 -12 in the day and others worked only two hours, it would be natural to expect more pay, wouldn’t it?

Is Your Eye Clear?

The point Jesus is making here is that the eye is not clear and greed enters the heart through our eyes. How would you define greed? Maybe it’s as simple as the desire for more. AI says it is characterized by a strong, often selfish, yearning for more than what is needed or deserved. Greed is often associated with materialism, envy, and a focus on self-interest.

Here’s how Tim Keller spoke about the eye and greed:

Greed is different than other sins. This is why Jesus says this is an eye sin. This darkens your eye spiritually. Jesus did not say to anybody, “Watch out, you might be committing adultery.” If you’re committing adultery; you know you’re committing adultery. You don’t say, “Oh, you’re not my wife!” It doesn’t happen. But Jesus has to say, Watch out, you might be greedy. Greed hides itself. It blinds you in a way that adultery doesn’t. Over the years as a pastor, I’ve had people come in to talk to me about sins, but I don’t remember anybody coming to me to confess the sin of greed.

https://www.plough.com/en/topics/faith/discipleship/watch-out-you-might-be-greedy

It’s such a challenge to recognize this darkness or even know it has found a place in our hearts. In fact, “The heart is deceitful above all things and beyond cure. Who can understand it?” (Jer. 17:9)

Jesus said that “from within, out of the heart proceed …” a long list which includes coveting and envy (Mark 7:21, 22). The word envy is literally “an evil eye.”

Tim Keller explained how easy it is for us to not even consider the possibility that we might be materialistic with this realistic example:

Materialism has the power to get you to choose a job, not one that you love, not one that you’re good at, not one that helps people, but one that makes you money. You do it because it will get you to a certain status in life. You choose the job on the basis of that. For five to ten years the adrenaline can keep you going, but after a while you find yourself empty inside. Why did you choose the job? Your eye was dark.

https://www.plough.com/en/topics/faith/discipleship/watch-out-you-might-be-greedy

Is Your Eye Focused?

When your eye is dark it is easier to refuse to help someone who has a genuine need (Deut. 15:9) than to truly have compassion and help them. Our response to others is determined by what is in our heart and Jesus is saying the entrance into the heart is through the eye. The instruction in the verse that follows is pretty clear:

Give generously to the poor, not grudgingly, for the LORD your God will bless you in everything you do.

Deut. 15:10 NLT

So what did Jesus mean when he spoke about a clear eye? It wasn’t just focusing on good things (as AI suggests), so your life will be filled with positive things. It was about having the right perspective – shifting your focus away from greed and discontentment which is the darkness. Instead, the light brings generosity and contentment into view. A clear eye means we view the resources we have differently, we begin to ask why we have these resources.

The “evil eye” focuses on getting more while the “good eye” focuses on giving more.

Let me wrap this up with Proverbs 22:9:

“He who is generous will be blessed, For he gives from his food to the poor.”

The newer translations just use the word generous here, but that word refers to one who “has a good eye” – the KJV translates it as one with a bountiful eye.

Consider this in light of what Jesus said:

“When your eye is healthy, your whole body is filled with light.”

The healthy or “bountiful eye” speaks of generosity that flows from an abundance mindset and is not restricted at all by scarcity thinking.

Do You Need Corrective Lenses?

In a 2012 study published in Science, behavioural economists Mullainathan and Shafir discovered something remarkable:

When we perceive scarcity (even if it doesn’t match reality), our brain undergoes a measurable shift. Our mental bandwidth narrows, focusing intensely on what we might lose while becoming blind to potential gains.

https://breakingbank.media/ca/breaking-the-scarcity-cycle-a-guide-for-smarter-wealth-management/?ref=sadeyemi&utm_source=email&utm_medium=email+marketing

This confirms what the Sermon on the Mount stated more than 2000 years earlier:

But when your eye is unhealthy (perceiving scarcity), your whole body is filled with darkness (your mental bandwidth narrows). And if the light you think you have is actually darkness, how deep that darkness is!

A scarcity mindset negatively limits our ability to be generous, which is a dark place. Lord, open our eyes to Your light and deliver us from the dark. For my physical eyes, I need corrective lenses and I use them every day. Do we not need the same discipline to wear our spiritual lenses daily? How else can we have “a bountiful eye?”